A man looks at the electronic board showing downward graph of share prices index at a securities company in Chengdu, in China’s southwestern province of Sichuan, on March 18, 2008. (Liu Jin/AFP via Getty Images)

By and

China’s business outlook has dropped to a historic low while revenue forecasts reached the lowest in a decade, according to hundreds of American businesses operating in the country.

An annual business report released by the American Chamber of Commerce in Shanghai (AmCham Shanghai) on Oct. 28 showed that only 55 percent of the companies surveyed were optimistic or slightly optimistic about China’s five-year business outlook, a significant 23-point drop from 2021.

Key findings in the 2022 China Business Report indicate that 47 percent of respondents project year-on-year revenue growth in 2022, plunging 29 points from last year and the lowest expectation in at least a decade.

Likewise, 47 percent of respondents expect revenue growth in China to outpace their companies’ worldwide growth over the next three to five years, dropping 22 points from last year.

In addition, 52 percent of the surveyed companies said their corporate headquarters’ confidence in China’s economic management has worsened in the past year, while only 18 percent ranked China as their top destination for investment, down from 27 percent in 2021.

The report also disclosed that only 17 percent of the companies surveyed said the country’s government policies and regulations toward foreign companies had improved in the past year, a 19 percent drop from 2021.

On top of AmCham Shanghai, the European Chamber of Commerce published similar warnings in a paper it said had input from 1,800 member companies, which also contained 967 recommendations for China, the European Union, and European companies related to doing business in the country.

In September, the top European industry group warned that firms were losing confidence in China and that its standing as an investment destination was being eroded, citing its “inflexible and inconsistently implemented” COVID-19 policy as a key factor.

The report, which touched on issues from Taiwan to trade, said, for example, that the Chinese regime should refrain from “erratic policy shifts.”

“The world lives with herd immunity, and China waits until the world gets rid of Omicron, which is, of course, unlikely,” the chamber’s president Joerg Wuttke told a media briefing, referring to the Chinese regime’s rigid zero-COVID stance, which has led to frequent lockdowns and kept borders mostly shut to international travel.

Besides COVID-19, the chamber said stalled reforms of China’s state-owned enterprises, an exodus of European nationals from China coupled with travel restrictions for Chinese staff to go abroad, and increased business politicization were also harming China’s attractiveness.

The report said record numbers of businesses looked to shift current or planned investments to other markets.

Significant Outflow of Foreign Capital

Although the reports released by AmCham Shanghai and the European Chamber both indicated a severely deteriorating business environment and declining foreign investment in China, the state-owned China Securities Journal published an article suggesting that foreign companies are “collectively optimistic” about the Chinese market and that foreign investment had increased year-over-year.

In response to the claims made by the Chinese state-owned media, Grace Li, a Singapore-based economist specializing in the Chinese economy, told The Epoch Times that the Chinese data lacks credibility.

“For example, in September, Bloomberg reported that China’s use of foreign capital increased 17.3 percent in the first seven months of this year compared to the same period last year. However, it was discovered that 76 percent of the so-called foreign capital was funds transferred back to mainland China via Chinese-funded enterprises headquartered in Hong Kong,” Li said.

“Beijing’s zero-COVID policy, the sharp slowdown in the real estate market and economy, the rising U.S.-China tension, pro-Russian stance in the Russia-Ukraine war, and the threat of war against Taiwan, are all factors that have led to the continuing foreign capital withdrawal from China.”

She said that data from the Institute of International Finance (IIF), an global trade association, showed that in the eight months from February to September of this year, more than $98.2 billion in foreign capital was withdrawn from the Chinese bond market.

“After the 20th Party Congress of the Chinese Communist Party (CCP), not only the Hong Kong stocks, the A-share market plummeted, as well the yuan exchange rate and Chinese stocks in the U.S. and China also plummeted. These are strong indications that foreign investors are not optimistic about the Chinese market and are ‘voting with their feet’ to speed up capital withdrawal from China,” Li added.

Chinese investors in front of a stock price board showing falling prices at a private security firm in Shanghai on Oct. 6, 2008. (Mark Ralston/AFP via Getty Images)

Declined Foreign Business Confidence: Three Major Factors

In a short introduction video to the 2022 China Business Report, Sean Stein, chairman of AmCham Shanghai, identified “three major factors” the surveyed companies said would do the most to help their business in China.

The most received response was “easing China’s zero-COVID policies,” followed by “an improvement in U.S.-China relations” and “the growth of China’s consumer market.”

According to the report, 19 percent of surveyed companies are reducing their investments in China this year compared to last year. The top reasons are all related to the country’s pandemic prevention policies.

While countries worldwide have completely lifted or substantially eased COVID-related travel restrictions, China has shown no signs of easing its stringent zero-COVID policy.

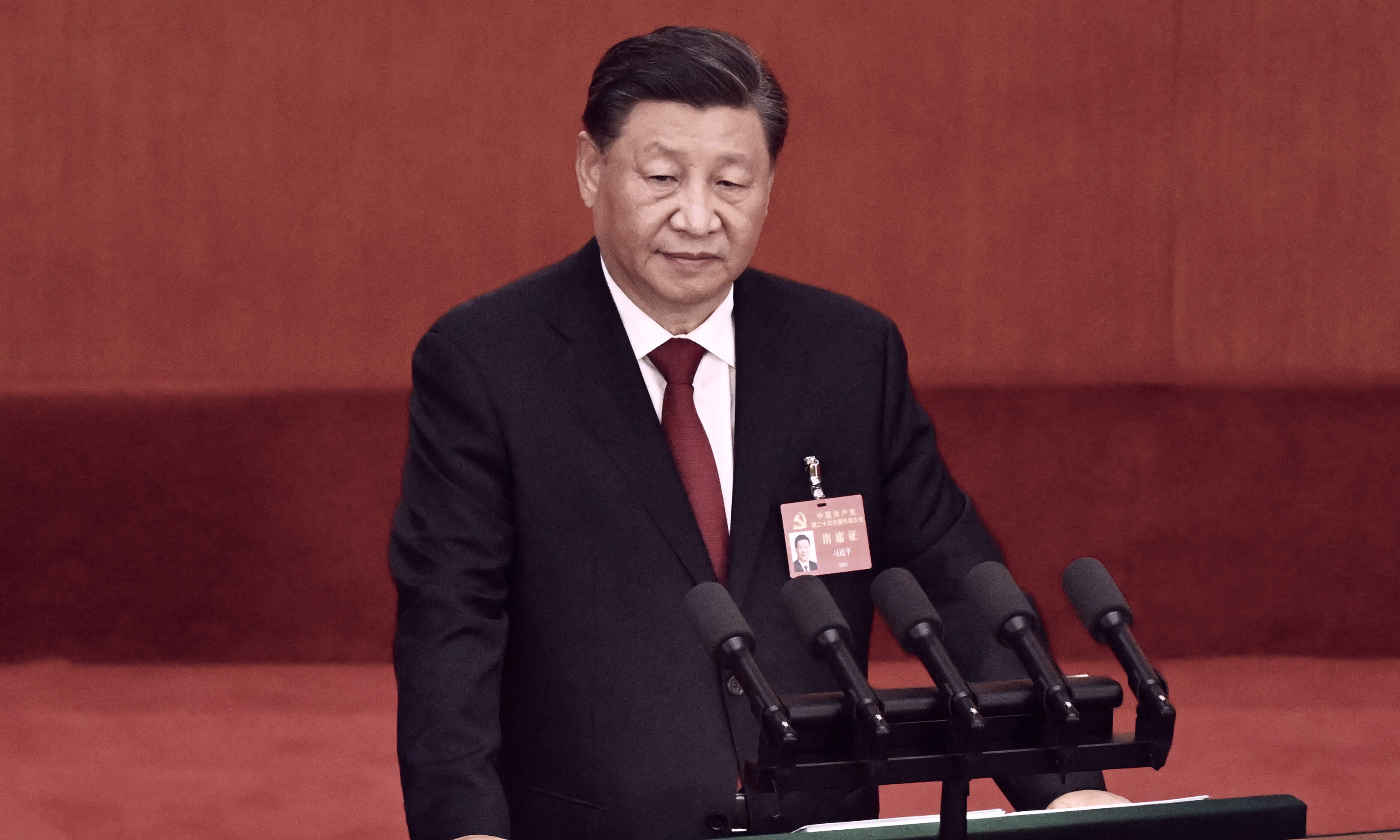

Chinese leader Xi Jinping’s remarks at the recently-concluded 20th Party congress appear to dash the hopes of Chinese people looking for signs of the policy loosening. The draconian approach aims to eliminate every infection among communities through strict lockdowns, repeated testing, and mass surveillance.

Chinese leader Xi Jinping gives a speech during the opening session of a major Chinese Communist Party’s political conference in Beijing on Oct. 16, 2022. (Noel Celis/AFP via Getty Images)

Likewise, the outlook of U.S.-China relations continues to be bleak, as perceived by media and experts.

Li said the CCP appears to be preparing for possible U.S.-China conflicts in the future. And that China is actively rebuilding supply and marketing cooperatives, state-run canteens for wars and famines, and accelerating toward a planned economy.

“The Chinese consumer market is also very sluggish,” Li said. “The lockdown measures have significantly impacted both production and consumption, leading to higher unemployment and lower incomes, forming a vicious circle. Many of the so-called middle class have returned to poverty.”

Meanwhile, China’s real estate sales continue to slump, property firms are experiencing debt crises, and financial risks continue to escalate.

AmCham’s report indicates that more than 56 percent of the companies surveyed believe that current Chinese government policies favor local companies, five percent higher than last year and the highest level since 2017.

Tiger Global Management, an American investment firm and longtime China investor, has suspended investing in China as it reassesses the risks. The firm has reduced its holdings of Chinese stocks this year and shifted its investment focus to India and Southeast Asia. The move was reportedly driven by increased geopolitical tensions and Beijing continuing its zero-COVID policy.

Li added that as long as China continues to suppress its own private economy, it is unlikely to see an increase in the inflow of foreign capital.

Reuters contributed to this report.